Company Background

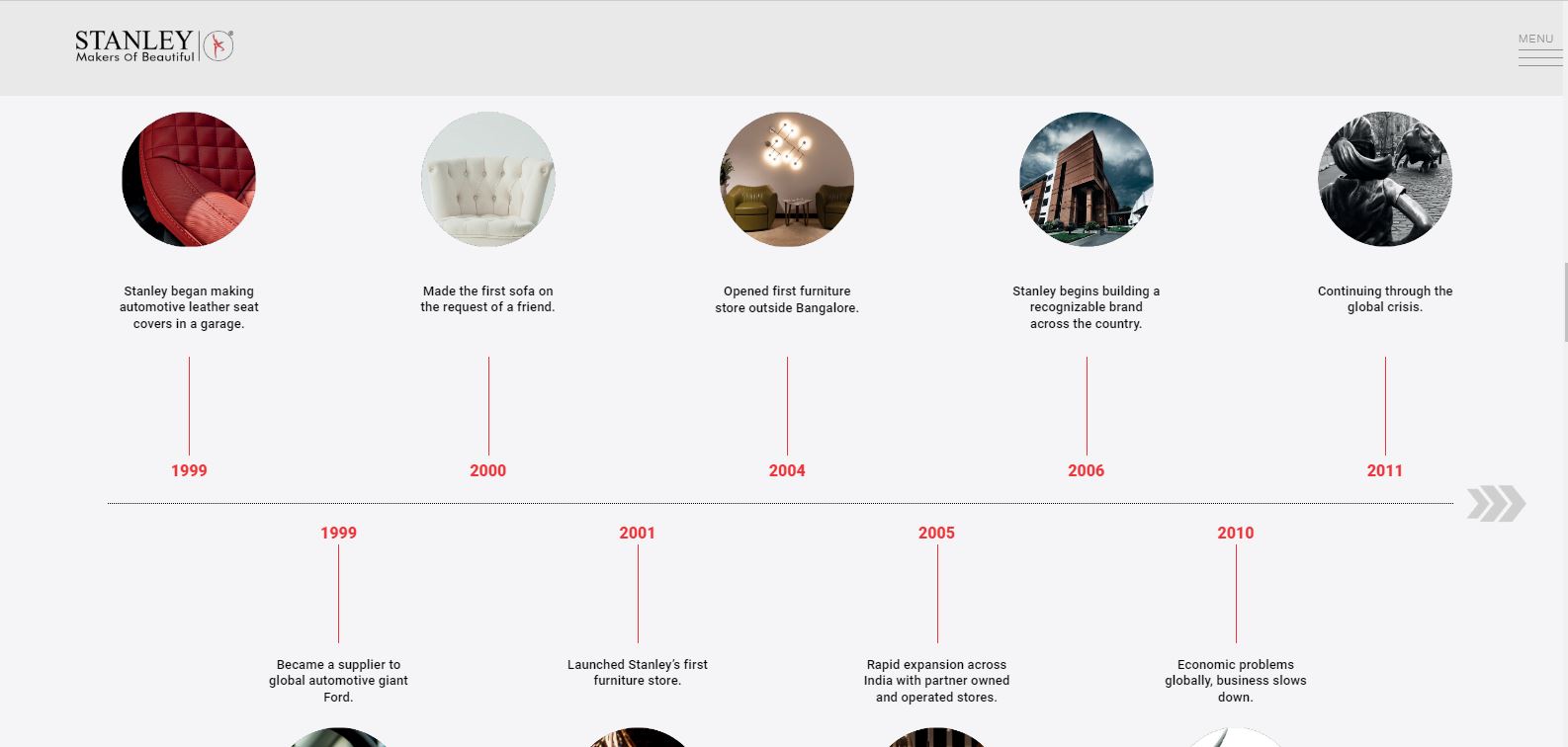

Stanley Lifestyles Ltd, originally established as a partnership firm named Stanley Seating in 2007, transformed into a public limited company in October 2007. The company specializes in manufacturing and trading luxury furniture and leather products. Starting with car seat leather upholstery services, Stanley Lifestyles has evolved into a prominent luxury furniture retailer in India. It operates over 50 stores across various formats, including franchisee-owned and company-operated outlets.

IPO Details

- Issue Period: June 21, 2024 – June 25, 2024

- Issue Price Band: ₹351 – ₹369 per equity share

- Market Lot: 40 shares

- Total IPO Size: ₹537.02 crores

- Face Value: ₹2 per equity share

- Listing At: BSE, NSE

- IPO Issue Type: Book Building Issue

IPO Lot Size

Investors can bid for a minimum of 40 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 40 | ₹14,760 |

| Retail (Max) | 13 | 520 | ₹191,880 |

| S-HNI (Min) | 14 | 560 | ₹206,640 |

| S-HNI (Max) | 67 | 2,680 | ₹988,920 |

| B-HNI (Min) | 68 | 2,720 | ₹1,003,680 |

IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| QIB Shares Offered | Not more than 50.00% of the Net offer |

| Retail Shares Offered | Not less than 35.00% of the Offer |

| NII (HNI) Shares Offered | Not less than 15.00% of the Offer |

IPO Promoter Holding

Sunil Suresh and Shubha Sunil are the promoters of the company.

| Share Holding Pre Issue | 67.36% |

| Share Holding Post Issue | 56.81% |

Important Dates

- Opening Date: June 21, 2024

- Closing Date: June 25, 2024

- Finalization of Basis of Allotment: June 26, 2024 (Tentative)

- Initiation of Refunds: June 27, 2024 (Tentative)

- Transfer of Shares to Demat Account: June 27, 2024 (Tentative)

- Listing Date: June 28, 2024 (Tentative)

Financial Performance

Consolidated Figures (in ₹ crores)

| Metrics | FY23 | FY22 | FY21 |

|---|---|---|---|

| Total Assets | 368.13 | 329.57 | 247.00 |

| Sales | 419.00 | 292.20 | 195.78 |

| Direct Expenditure | 245.19 | 190.93 | 109.62 |

| Gross Profit | 173.81 | 101.27 | 86.16 |

| Operating Expenditure | 82.99 | 35.45 | 49.44 |

| Operating Profit | 90.82 | 65.82 | 36.72 |

| Other Income | 6.62 | 5.55 | 5.93 |

| Interest | 16.17 | 12.14 | 9.79 |

| Depreciation | 28.25 | 21.75 | 20.71 |

| Profit Before Tax | 46.40 | 31.93 | 6.22 |

| Tax | 11.42 | 8.71 | 4.30 |

| Profit After Tax | 34.98 | 23.22 | 1.92 |

| EPS (unadjusted) | 44.60 | 28.96 | 1.40 |

Standalone Figures (in ₹ crores)

| Metrics | FY23 | FY22 | FY21 | FY20 | FY19 |

|---|---|---|---|---|---|

| Total Assets | 193.95 | 199.78 | 115.64 | 110.28 | 113.42 |

| Sales | 228.24 | 168.82 | 125.39 | 152.55 | 182.94 |

| Direct Expenditure | 167.06 | 124.24 | 75.49 | 82.67 | 115.57 |

| Gross Profit | 61.18 | 44.58 | 49.90 | 69.88 | 67.37 |

| Operating Expenditure | 32.53 | 16.98 | 40.50 | 57.84 | 42.65 |

| Operating Profit | 28.65 | 27.60 | 9.40 | 12.04 | 24.72 |

| Other Income | 15.41 | 9.52 | 5.78 | 7.28 | 5.55 |

| Interest | 6.05 | 5.38 | 1.17 | 0.75 | 0.85 |

| Depreciation | 9.93 | 8.78 | 2.76 | 2.44 | 2.19 |

| Profit Before Tax | 12.67 | 13.44 | 5.47 | 8.85 | 21.68 |

| Tax | 3.96 | 3.94 | 4.10 | 0.55 | 6.44 |

| Profit After Tax | 8.71 | 9.50 | 1.37 | 8.30 | 15.24 |

| EPS (unadjusted) | 11.82 | 12.89 | 1.86 | 11.26 | 20.68 |

Objectives of the IPO

The net proceeds from the IPO will be utilized for the following purposes:

- Expenditure for opening new stores.

- Expenditure for opening anchor stores.

- Expenditure for renovating existing stores.

- Funding capital expenditure requirements for purchasing new machinery and equipment by the company and its subsidiary, Shrasta Decor Private Limited (SDPL).

SWOT Analysis

Strengths

- Established Brand: Stanley Lifestyles is a well-known brand in the luxury furniture segment in India.

- Diversified Product Range: The company offers a comprehensive range of home solutions, catering to various customer needs.

- Strong Retail Network: With over 50 stores across India, the company has a significant retail presence.

Weaknesses

- High Operating Costs: The company has high operating expenditures, which can impact profitability.

- Dependence on Premium Market: Reliance on the luxury segment can make the company vulnerable to economic downturns affecting discretionary spending.

Opportunities

- Market Expansion: There is potential for further expansion in tier-2 and tier-3 cities.

- Increasing Demand: Growing demand for premium and luxury home solutions in urban areas.

Threats

- Economic Slowdown: An economic slowdown can affect the purchasing power of customers, impacting sales.

- Intense Competition: The luxury furniture market is competitive, with several established players.

Contact Information

- Address: SY.# 16/2 & 16/3 Part Hosur Rd, Veerasandra Vi. Attibele Hobli 560100

- Phone: +91 80 6895 7200

- Email: [email protected]

- Website: Stanley Lifestyles

Registrar of IPO

- KFin Technologies Ltd

- Phone: 91-40-67162222

- Fax: 91-40-23001153/23420814

New to Investing or Trading? Open an account here.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Potential investors should consult with their financial advisors before making any investment decisions. All information has been sourced from reliable publications and the company’s IPO prospectus. However, we do not guarantee the accuracy or completeness of this information.

Leave a Reply