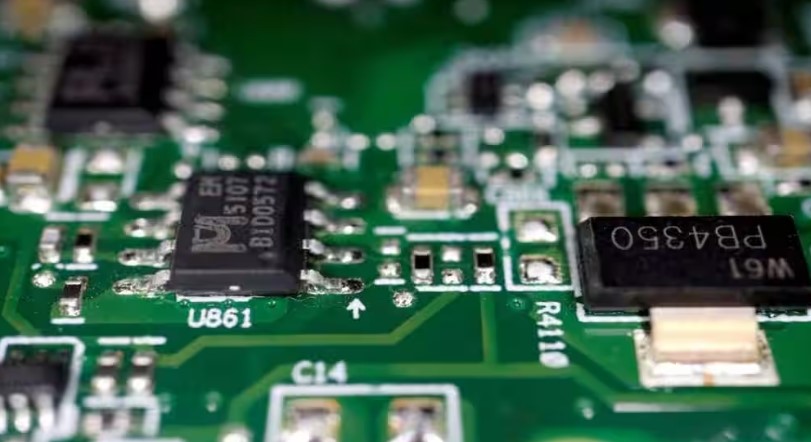

MeitY Engages BCG for Rs 15-20 Crore SCL Mohali Modernisation Plan

The Ministry of Electronics and IT (MeitY) is advancing its efforts to upgrade the Semi-Conductor Laboratory (SCL) in Mohali with Boston Consulting Group (BCG), allocating Rs 15-20 crore for the consultancy. BCG will develop a request for proposal (RFP) to attract semiconductor companies for 28-nanometer chip technology. SCL, currently producing 180 nm chips, aims to increase capacity and support startups, R&D, and prototyping, potentially investing Rs 20,000 crore to expand wafer production.

Source: Financial Express

Reliance Jio Implements Major Tariff Hikes Effective July 3, 2024

Starting July 3, 2024, Reliance Jio will significantly increase tariffs across all prepaid and postpaid plans. Monthly plans will now start at Rs 189 for 2GB data, while annual plans will reach up to Rs 3,599 for 2.5GB/day. Alongside, Jio introduces JioSafe and JioTranslate apps, available free for a year to Jio users. These changes aim to support Jio’s investments in 5G and AI technology.

Source: Business Today

India Seeks to Accelerate Power Grid Link Talks with Sri Lanka

India is expediting discussions with Sri Lanka to establish a power grid link for renewable energy trading. The project includes overhead and under-sea cables, with PwC India evaluating economic benefits. The aim is to sign an MoU between India’s Power Grid Corporation and Sri Lanka’s Ceylon Electricity Board. Renewed interest in the project aligns with India’s strategy to strengthen regional energy ties and follows technical feasibility studies indicating potential financial benefits.

Source: Economic Times

IIFL Securities Crashes 10% Following SEBI Probe into Sanjiv Bhasin’s Alleged Stock Manipulation

Shares of IIFL Securities plunged over 10% after SEBI began investigating Sanjiv Bhasin for alleged stock manipulation. Bhasin, a consultant with IIFL, reportedly directed a private company to buy specific stocks before recommending them on media channels. His contract ended prematurely on June 17, 2024, due to health reasons. The probe examines Bhasin’s digital records and potential involvement in a ‘pump and dump’ scheme.

Source: Live Mint

Experts Urge Increased Budget Focus on Health and Education

In pre-Budget consultations, experts urged Finance Minister Nirmala Sitharaman to increase focus on health and education sectors. For FY25, the Ministry of Health’s outlay is ₹90,659 crore, a slight rise from ₹89,155 crore in FY24. Education funding rose nearly 7% to ₹1,20,628 crore. Recommendations include improving school and hospital facilities, filling vacancies, and monitoring social sector schemes. Calls were also made to raise public spending on education and health to 6% and 3% of GDP by FY31, respectively.

Source: Economic Times

RBI Reports Drop in Household Savings and Rise in Financial Liabilities Post-Covid

The RBI’s 29th Financial Stability Report highlights a decline in household savings to 18.4% of GDP in FY23, down from the 2013-22 average of 20%. Net financial savings fell to 28.5% in FY23, compared to 39.8% previously. Household financial liabilities have risen, reflecting increased retail loan growth for consumption and investment. The central bank emphasizes close monitoring of household debt due to these trends.

Source: Business Today

SEBI Tightens Rules for Derivatives Market, Forms Expert Group

SEBI has introduced stricter entry and exit criteria for stocks in the derivatives segment to enhance market regulation and investor protection. The new rules mandate that stocks must be among the top 500 in market capitalisation and traded value, with higher limits for market-wide positions and median order sizes. An expert group will review the Futures & Options category, with findings submitted to the secondary market advisory committee. These changes aim to ensure a robust securities market ecosystem.

Source: Business Today

Reliance Retail Fast-Tracks FMCG Expansion with ₹1,053 Crore Funding

Reliance Retail Ventures has invested ₹1,053 crore in its FMCG arm, Reliance Consumer Products (RCPL), over 14 months. RCPL, operational since November 2022, received ₹792 crore in FY24 for scaling operations. Funds will support expanding distribution, setting up production hubs, and acquiring brands like Campa Cola and Maliban Biscuits. Reliance aims to overcome capacity constraints and enhance localized supply chains to boost its FMCG market presence.

Source: Economic Times

Scheme Launched to Integrate 500,000 MSMEs into ONDC

The Indian government introduced the TEAM scheme with a ₹277 crore outlay to help 500,000 MSMEs join the Open Network for Digital Commerce (ONDC). Additionally, the Yashasvini initiative aims to empower 100,000 female entrepreneurs through skill development and training. MSME Minister Jitan Ram Manjhi emphasized the importance of these initiatives for inclusive growth and India’s 2047 Viksit Bharat goal. The schemes also include Khadi brand rejuvenation and micro-enterprise support.

Source: Economic Times

India’s Credit Market to Benefit from Global Bond Index Inclusion

India’s inclusion in global bond indexes, starting with JPMorgan’s flagship emerging markets bond index, is set to boost the country’s fixed-income market. This move is expected to draw $3 billion monthly inflows into government bonds, subsequently lowering corporate capital costs. Aditi Mittal, co-founder of IndiaBonds.com, predicts increased foreign investment in corporate bonds, starting with state-run firms and expanding to those with lower ratings. Currently, foreign investors use only 16% of their investment limit in India’s corporate bonds.

Source: Finance Yahoo

SEBI to Enforce Fraud Detection Mechanism in Mutual Fund Industry

SEBI announced that the ₹50 lakh crore Indian mutual fund industry is finalizing an internal mechanism to detect market frauds like front-running and insider trading. Chairperson Madhabi Puri Buch emphasized that large fund houses must implement this system within three months after SEBI’s guidelines, while others have six months. This mandatory measure, starting April 2024, includes enhanced surveillance, internal controls, and procedures to deter potential market abuse.

Source: Business Today

Tata Group Retains Title of India’s Most Valuable Brand

Tata Group, valued at $28.6 billion, has maintained its position as India’s most valuable brand, according to Brand Finance. The group’s Taj Hotels also topped as the strongest Indian brand. Infosys ranked second, while HDFC surged to third following its merger with HDFC Ltd. The report highlighted significant growth in telecom (61%) and banking (26%) sectors, with brands like Jio, Airtel, and SBI driving this trend.

Source: MSN

Leave a Reply